|

|

|

|

|

The Pension Pulse |

|

As an experienced investment advisor, we stand ready to guide Plan Sponsors through the complexities and ever-changing landscape of pension plans. This newsletter provides valuable updates from Fiducient’s dedicated Defined Benefit Business Council. |

|

|

|

Another Good Year For Pension in 2025 |

|

This year was marked by significant events that reshaped both the markets and the global economy. This began with rapid policy changes, notably the tariff announcements on April 2, which triggered the sharpest one-week decline in U.S. stocks since the pandemic. Despite this volatility, global equities proved resilient, ultimately closing the year with robust double-digit gains for the third consecutive year. Notably, international stocks outperformed their U.S. counterparts in 2025. Bonds also delivered strong results, benefiting from the U.S. Federal Reserve’s move to reduce short-term interest rates.

Defined benefit plans also experienced another good year in 2025 largely due to investment returns outpacing liabilities. In 2025, FTSE estimates that plan liabilities increased by 6.8%1, excluding benefit accruals. Investments diversified across fixed income and equities generated returns 3% in excess of the liabilities, leading to improvements in pension plans’ funded statuses broadly. |

|

|

1FTSE Pension Liability Index - Short as of December 31, 2025.

260% MSCI World Index annual return plus 40% Bloomberg U.S. Aggregate Index annual return as of December 31, 2025.

320% MSCI World Index annual return plus 80% Bloomberg U.S. Long Gov/Credit Index annual return as of December 31, 2025.

Sources: Factset; FTSE Russell. |

|

| See What's Ahead - Read Our 2026 Outlook |

|

| Unwrap Our December Market Recap |

|

|

|

Insights From Your Trusted Team |

|

|

Cash Balance Plans |

|

Cash balance plans are qualified retirement plans that offer the stability of a pension plan with the ability for more transparency and portability similar to a 401(k) plan. A well-designed cash balance plan offers the ability to defer significantly more toward retirement savings than a 401(k) plan alone, without the funded status volatility of a traditional defined benefit plan on a Plan Sponsor’s balance sheet.

Cash balance plans continue to gain traction among many organizations, but professional service firms in particular are taking note - law firms, medical/dental practices, accounting/consulting groups, asset management firms and other closely held businesses look to cash balance plans to turbocharge tax deferral and retirement savings for employees and owners.

Innovative plan designs incorporating tiered investment options tailored to employees’ diverse risk and return profiles have been a topic of growing interest from Plan Sponsors. These enhancements underscore the flexibility and strategic value of cash balance plans in modern retirement planning for both employers and participants.

Please be on the lookout for upcoming webinars by Fiducient experts exploring the trends in the cash balance plan space and the benefits of these defined benefit plans for employees and employers. |

|

| Discover Your Secret Weapon - Watch Our Replay! |

|

Traditional Pension Plans |

|

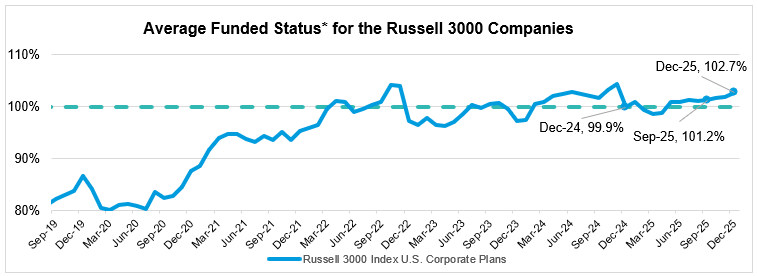

Throughout 2025, pension plans generally experienced notable improvements in their funded statuses. Among the Russell 3000 companies that maintain pension plans, the average funded ratio - which measures assets relative to liabilities - reached 102.7%. This represents a 2.8% increase over the course of the year (see chart below).

Pension plans with greater allocations to equities and shorter duration fixed income achieved more pronounced gains in funded status; plans that were more heavily invested in longer duration, liability-driven strategies maintained relatively stable funded statuses. |

|

|

|

Source: Wellington Asset Management as of December 31, 2025. |

|

| Your Pension Pulse Check - Read Our Pension Monitor* |

|

|

|

|

|

Interest/Discount Rates |

|

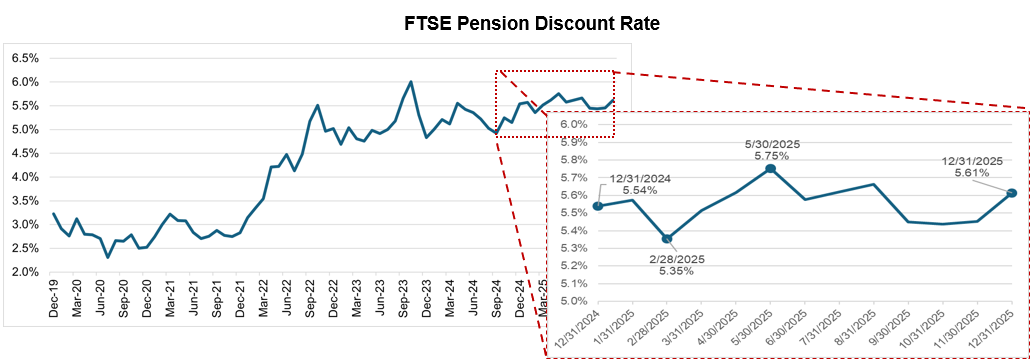

In 2025, although interest rates finished only seven basis points (0.07%) higher than where they started the year, the pension landscape was shaped by consistently high but unstable interest rates. The elevated rate environment generally supported stronger funded positions, however erratic month‑to‑month changes early in the year reinforced the need for disciplined liability management, nimble de‑risking and dynamic LDI oversight. Over the long term, it’s clear we are firmly in a new interest rate regime, with lasting implications for corporate defined benefit plan strategy, governance and risk management. |

|

|

|

|

Source: FTSE Russell Pension Liability Index. |

|

|

|

|

Pension Risk Transfer (PRT) and Plan Termination |

|

PRT transactions continue to garner significant interest from Plan Sponsors looking to transfer some or all or their pension liabilities off their balance sheets. Fiducient has robust resources to assist Plan Sponsors with every step of this complex and often nuanced process. Please reach out to us to see how we can help! |

|

|

|

|

Notable Deadlines for 2026 |

|

The deadline for ongoing, calendar year plans to adopt required and optional plan amendments related to the SECURE Act, the SECURE 2.0 Act and the CARES Act for qualified plans that are not governmental or collectively bargained is December 31, 2026. Other key deadlines for ERISA-governed defined benefit plans can be found here. |

|

|

|

Public Pension Plans |

|

Public pension plans continue to make progress on closing funding deficits. According to Milliman’s Public Funding Index, robust investment performance has significantly improved the funded statuses of the 100 largest U.S. public pension plans. Milliman estimates that the funded status of this group increased from 80% as of December 31, 2024, to 86.3% as of October 31, 2025, with the median investment return during the 10 months of 7.0%.4 |

|

Click below to read the latest issue of The Public Fiduciary Newsletter which provides key insights on the public pension landscape.

|

|

4Milliman’s Public Pension Funding Index November 2025. |

|

| Get The Scoop: The Public Fiduciary Newsletter |

|

|

|

Comprehensive Investment Consulting Services |

|

In addition to pension plan investment advisory services, we also offer consulting services to defined contribution plans, endowments and foundations and private wealth. Our comprehensive fiduciary advisory services are designed to help support and strengthen your financial goals at every stage. |

|

|

Special Opportunity! |

Your 2026 Wealth Checkup: Live Session

Tuesday, February 3 | 12:00 PM EST |

|

|

Set the tone for a successful year by aligning your financial goals with smart strategies. Join to hear practical insights from our 2026 Financial Planning Guide, your roadmap to navigating the year ahead. Key topics for discussion will include: |

|

|

|

|

|

|

|

|

This report is intended for the exclusive use of clients or prospective clients (the “recipient”) of Fiducient Advisors LLC, A Wealthspire Company, and the information contained herein is confidential and the dissemination or distribution to any other person without the prior approval of Fiducient Advisors LLC, A Wealthspire Company is strictly prohibited. Information has been obtained from sources believed to be reliable, though not independently verified. Any forecasts are hypothetical and represent future expectations and not actual return volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation. The opinions and analysis expressed herein are based on Fiducient Advisors LLC, A Wealthspire Company research and professional experience and are expressed as of the date of this report. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is risk of loss.

|

|

|