|

|

|

PENSION PULSE | JULY 2025 |

|

As an experienced advisor, we stand ready to guide Plan Sponsors through the complexities and everchanging landscape of pension plans. This newsletter provides valuable updates from our dedicated Defined Benefit Business Council. |

|

|

|

Stock Resiliency Amid Rate Volatility |

|

Despite geopolitical tensions and tariff ping-pong, stock markets proved remarkably resilient, helping to improve pension funded statuses this quarter and effectively offsetting much of the negative performance experienced during the first quarter.

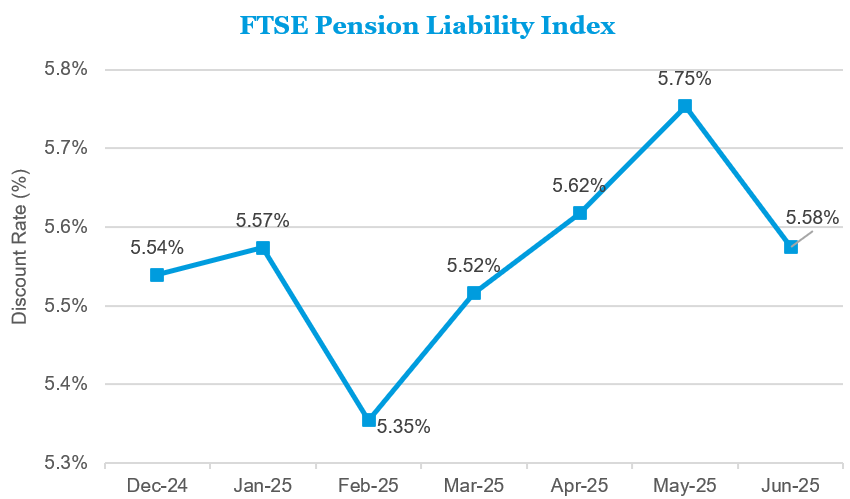

Although discount rates used to value liabilities declined to 5.58% in June and ended nearly unchanged from the beginning of the quarter and year, this perceived stability belied significant underlying rate volatility.

|

|

|

Source: Morningstar Direct as of 6/30/2025; FTSE Pension Liability Index provided by London Stock Exchange Group plc. |

|

|

|

|

|

|

|

Insights From Your Trusted Team |

|

|

|

Traditional Pension Plans |

|

|

|

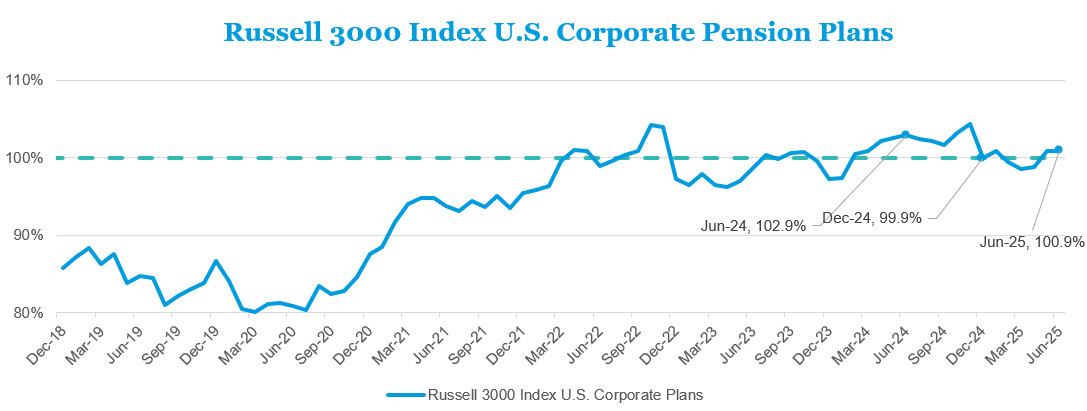

In general, pensions experienced another month of funded status gains in June to end the quarter and the year in a more favorable position due to robust stock market performance. Both of the composites we monitor showed funded status gains: the Russell 3000 companies average funded status ended June at 100.9% funded, bringing its year-to-date gain to 1% after losing 1% during first quarter. Plans with higher allocations to equities saw more robust gains versus the stability of plans with a higher allocation to liability driven investment strategies. |

|

|

|

|

Source: Wellington Asset Management as of June 30, 2025. Use of Indices and Benchmark Return Indices cannot be invested in directly. Index performance is reported gross of fees and expenses and assumes the reinvest dividends and capital gains. Past performance does not indicate future performance and there is a possibility of a loss. See disclosure page for indices representing each asset class. |

| Check Out Our Pension Monitor >> |

|

|

|

Plan Sponsors Should Take Note |

|

PBGC premiums are due one month earlier for calendar year 2025 only due to the Bipartisan Budget Act of 2015. This means that for calendar year plans, this year’s PBGC premium is due by September 15, 2025. Additionally, Plan Sponsors should consult with the plan’s actuary regarding whether making the required October 15 contribution prior to September 15 can reduce the premium amount owed. |

|

Source: Pension Benefits Guaranty Corporation |

|

|

|

|

|

Actual market rate cash balance plans are a powerful and flexible alternative to more traditional plan designs. In our blog post, A Missing Piece in Your Cash Balance Plan Strategy: A True Investment Partner, find out what makes this design superior and why we believe it is critical to work with an investment partner like Fiducient Advisors, who specializes in cash balance plans. |

|

|

|

|

|

Opportunities to enhance employee benefits, boost retention, attract talent and cut costs may exist for Sponsors of overfunded plans through a cash balance plan design, similar to the changes implemented recently by IBM, Southwest Airlines and other large Plan Sponsors. Read more in the recent Chief Investment Officer article, As Many DB Plans Reach a Surplus, Plan Sponsors Have Options. |

| Jump to Article >> |

|

|

|

|

|

Strong investment returns have propelled funded status of US public pension plans higher, according to Milliman’s Public Funding Index June 2025. As of June 30, 2025, the trailing one-year return for global stocks was over 16% and the Bloomberg US Aggregate Bond index returned over 6% during the same period1. |

|

|

|

|

|

1Source: Morningstar Direct as of June 30, 2025. |

|

|

|

Fiducient Advisors will be attending the OPAL Group Public Funds Summit on July 23, 2025 in Newport, RI where Christopher Rowlins, Partner and Senior Consultant, will be discussing tools for enhancing governance, fiduciary duty and preventing conflicts. We hope to see you there! |

|

|

|

Pension Risk Transfer (PRT) and Plan Termination |

|

|

|

PRT transactions continue to garner significant interest from Plan Sponsors looking to transfer some or all or their pension liabilities. And insurance companies continue to meet this demand across 22 providers, with the newest entrant, Delaware Life Insurance, jumping into the PRT market in February of this year.

|

|

|

|

Legal & General reports that first quarter’s transactions are estimated to total around $7 billion following a nearly record-breaking 2024 at $51.9 billion. Excluding two jumbo transactions in first quarter 2024 that totaled over $10 billion, the first quarter of this year remains comparable to first quarter 2024 and will close as the second highest first quarter on record. |

|

Source: BCG Pension Risk Consultants; Legal & General Retirement America PRT Monitor – 1Q2025. Use of Indices and Benchmark Return Indices cannot be invested in directly. Index performance is reported gross of fees and expenses and assumes the reinvest dividends and capital gains. Past performance does not indicate future performance and there is a possibility of a loss. See disclosure page for indices representing each asset class. |

|

|

|

Get Expert Insights. Delivered Regularly.

Stay informed with our latest perspectives. Get our research and blog posts directly to your inbox. Subscribe to our Fiducient Advisors' Insights today.

|

| Subscribe >> |

|

|